When discussing the Bristol Myers Squibb price target, many investors are closely monitoring the company’s recent performance metrics and strategic decisions. Despite posting an unexpected earnings beat of $1.80 per share in the first quarter, which surpassed analyst expectations, the Bristol Myers stock is facing serious market headwinds. The recent downturn, with shares dropping around 20% in April, has prompted a reassessment of the price target, now adjusted down to $60 from $70. Issues surrounding tariff uncertainties and a stalled pipeline raise critical questions about Bristol Myers’ next steps. As analysts delve into Bristol Myers earnings, the focus shifts to how the company plans to navigate challenges and restore investor confidence amid rising competition and clinical trial setbacks.

In the realm of pharmaceutical investments, understanding the target valuation of Bristol Myers Squibb, often referred to as BMY, is becoming increasingly vital. The company’s recent earnings report highlighted both strengths and weaknesses, leading to a cautious outlook for its stock analysis. While the monthly revenue forecast reflects some resilience, recent clinical trials, particularly those involving the new drug Cobenfy, have cast doubt on future growth trajectories. This mix of optimism for established drugs and concern for upcoming therapies illustrates the complexity of Bristol Myers’ road ahead. Investors must stay informed about the adjustments in revenue guidance and the broader implications of upcoming trial outcomes on the company’s market standing.

Understanding Bristol Myers Squibb’s Recent Earnings Report

Bristol Myers Squibb recently released its first-quarter earnings results, showcasing a significant earnings beat that caught the attention of many investors. Despite reporting a revenue decline of 6% year-on-year, with figures totaling $11.2 billion, the company exceeded analyst expectations of $10.7 billion. The adjusted earnings per share (EPS) of $1.80 surpassed forecasts of $1.49, demonstrating potential resilience within some aspects of their business. However, this performance was overshadowed by the general market conditions and the underwhelming outlook stemming from their ongoing clinical trials and the uncertainty surrounding tariff implications.

The financial landscape for Bristol Myers Squibb indicates a mixed picture. Although the earnings surpassed projections, the stock market’s reaction was tepid, declining by around 20% during April due to concerns surrounding tariff impacts and setbacks in their product pipeline. Notably, the recent failure of clinical trials concerning Cobenfy, their new schizophrenia treatment, has heightened investor apprehension. The strong sales growth driven by established drugs like Eliquis and Revlimid is a double-edged sword, as it brings into question the company’s long-term sustainability amidst looming generic competition.

Bristol Myers Squibb Price Target: Why We Lower Our Expectations

In light of the recent earnings report, analysts have adjusted their price target for Bristol Myers Squibb, lowering it from $70 to $60 despite the earnings beat. This decision reflects serious concerns about the company’s future trajectory amidst intensifying market pressures and uncertain trial outcomes. The lowered price target indicates a cautious outlook, factoring in potential setbacks from generic competition and disappointments from critical products. Investment strategies are evolving as the market digests these developments, pushing investors to reevaluate their positioning in Bristol Myers stock.

Moreover, the decreased price target comes during a challenging period for Bristol Myers, exacerbated by concerns around recent trial failures, including Cobenfy’s performance. The company has struggled to sustain its competitive edge against growing generic threats while trying to capitalize on new drug approvals. The fluctuations in revenue forecasts also contribute to a lack of confidence; analysts have expressed apprehension regarding Bristol Myers’ ability to consistently deliver robust growth, prompting a reevaluation of their valuation models and future earnings potential.

The Impact of Cobenfy on Bristol Myers’ Growth Prospects

Cobenfy, a critical part of Bristol Myers’ recent strategic initiatives, faces a pivotal moment in its journey after disappointing trial results. The drug was positioned to play a significant role in offsetting patent expirations for products like Eliquis and Opdivo. Early sales numbers were promising, revealing that Cobenfy generated $27 million in revenue during its first quarter—higher than the anticipated $17 million. However, the complexities introduced by the drug’s recent clinical trial outcomes have altered the trajectory of investor confidence in the broader portfolio.

Bristol Myers has continued to focus on Cobenfy, with management optimistic about the long-term prospects despite the recent setbacks. Plans are underway for further late-stage trials exploring its efficacy in treating Alzheimer’s and other conditions, showcasing the company’s commitment to maximizing Cobenfy’s potential. Nevertheless, failing to meet clinical expectations can have significant implications, particularly when future growth hinges on the success of innovative therapies like Cobenfy in a competitive landscape marked by increasing generic alternatives.

Financial Guidance and Revenue Forecasts for Bristol Myers

In its latest earnings call, Bristol Myers Squibb raised its full-year revenue guidance slightly, projecting sales between $45.8 billion and $46.8 billion, an increase bolstered by foreign exchange benefits. Notably, the company anticipates performance in its legacy portfolio to decline less harshly than expected, particularly driven by Revlimid’s resilience. This adjustment presents a nuanced view of Bristol Myers’ operational effectiveness amid significant market challenges, including tariff uncertainties that have further complicated the financial landscape.

However, analysts remain skeptical about the sustainability of this revenue forecast, given the historical performance of its key products facing patent expirations. As they navigate this complex environment, Bristol Myers aims to maintain operational margins and manage growth expectations prudently. The dual strategy of relying on enduring legacy products while simultaneously cultivating newer growth drivers indicates a cautious optimism—a balancing act that will require careful oversight as the competitive landscape evolves.

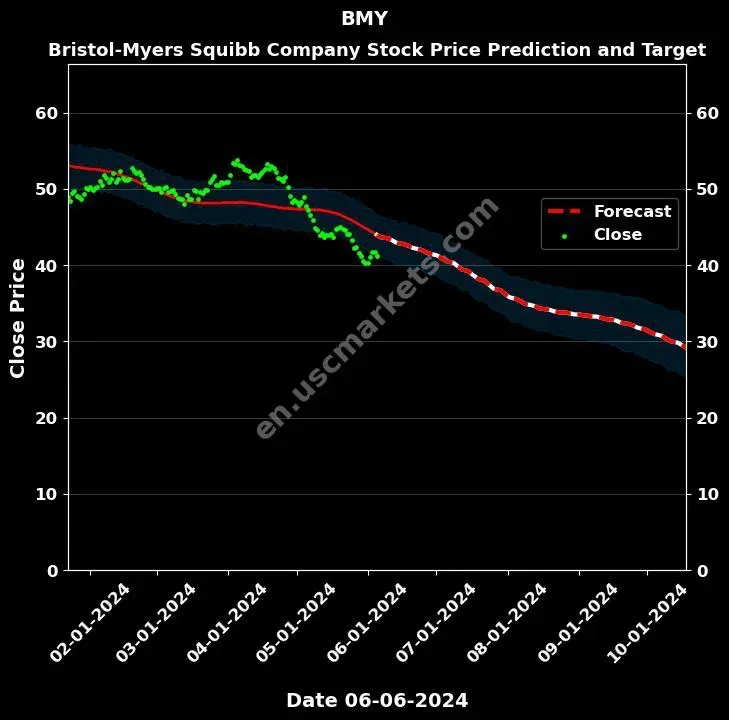

Analyzing Bristol Myers Stock Performance Amid Market Conditions

Bristol Myers Squibb’s stock has recently experienced significant volatility, drawing attention from investors concerned about the company’s long-term prospects. The decline of approximately 20% in the stock value this month reflects broader market sentiments influenced by the company’s clinical trial outcomes and external economic pressures including tariff uncertainties. The financial community is also assessing overall investor sentiment as the company navigates through challenges that extend beyond earnings reports, highlighting a crucial juncture in Bristol Myers’ market journey.

Despite this volatility, confident investors point out the attractive dividend yield and the relatively low valuation of less than 8 times forward earnings as compelling factors for maintaining interest in Bristol Myers shares. The perspective that current prices may offer a beneficial entry point is counterbalanced by the need for clear evidence of clinical success and solid revenue performance from new products like Cobenfy. Balancing these sentiments showcases the complexities inherent in stock analysis for a company facing both significant hurdles and opportunities.

Bristol Myers’ Competitive Landscape and Target Market

The competitive landscape for Bristol Myers Squibb includes major players like AbbVie, Pfizer, Amgen, Johnson & Johnson, and Merck, making it essential for the company to maintain a robust portfolio to remain relevant. In the face of increasing generic competition, particularly for its leading therapies, the company must react swiftly to capitalize on emerging market needs. The introduction of innovative treatments like Cobenfy is pivotal not only in diversifying the product portfolio but also in establishing the company’s standing in the highly competitive pharmaceutical market.

Furthermore, the focus on Cobenfy speaks to Bristol Myers strategy of addressing potential patient needs by offering specialized treatment options in high-demand areas such as schizophrenia and Alzheimer’s disease. As the industry moves toward more personalized medicine, the ability to swiftly shift and adapt in response to patient and market demands becomes paramount. The need to establish a foundational treatment protocol for Cobenfy could very well determine Bristol Myers’ strategic positioning and its ability to maintain a competitive edge in the evolving healthcare landscape.

Future Clinical Trials and Their Significance for Bristol Myers

Future clinical trials are a cornerstone of Bristol Myers’ strategy for growth and innovation, especially concerning Cobenfy’s potential expansions into Alzheimer’s-related conditions. Executives have announced intentions to initiate several late-stage trials aimed at establishing the drug’s efficacy beyond schizophrenia treatment. The results of these trials are critical to determining the drug’s market viability and the company’s broader growth trajectory amidst existing pressures from generics and patent expirations.

Investors are eagerly awaiting results from these prospective studies, anticipating that successful data could rejuvenate interest in the stock while reaffirming Bristol Myers Squibb’s reputation in the marketplace. The success or failure of these trials could have profound implications not only for Cobenfy but also for the future direction of the company’s pipeline, especially as management strategically prioritizes innovation to mitigate the impacts of patent cliffs.

Market Sentiment and Analysts’ Perspectives on Bristol Myers

Market sentiment towards Bristol Myers Squibb has shifted significantly in recent weeks, influenced predominantly by the fallout from recent trial results and broader economic conditions. Analysts have taken a cautiously optimistic stance, underscoring that while earnings beats provide a temporary cushion against stock volatility, long-term investor confidence hinges on successful execution of strategic trials. The lowered price target is a direct reflection of analysts adjusting their expectations based on perceived risks and potential future earnings.

The conversation surrounding Bristol Myers is marked by a dual perspective; on one hand, there is excitement about innovations like Cobenfy, and on the other, apprehension regarding their historical performance under pressure. As investors grapple with these conflicting narratives, understanding that market sentiment can heavily impact stock performance becomes increasingly important. Analysts are keenly monitoring upcoming developments, emphasizing that sustained growth will depend on how effectively the company can navigate its challenges and capitalize on new opportunities.

The Role of Dividend Yield in Bristol Myers’ Investment Appeal

The dividend yield offered by Bristol Myers Squibb, currently standing at about 5%, stands out as a significant attraction for income-focused investors. This yield brings a layer of stability to investor portfolios, especially during periods of stock price volatility. Given the company’s fundamentals, particularly its past performance in delivering consistent dividend payouts, this feature is often touted as a buffer against market fluctuations, making Bristol Myers a potentially valuable option for investors seeking both growth and income.

However, the viability of maintaining such a dividend yields faces scrutiny as analysts evaluate the company’s long-term growth potential amid rising generic competition and pressures resulting from recent clinical trial outcomes. The balance between sustaining attractive dividends while investing in innovation and new product developments is a delicate one for Bristol Myers. For investors, understanding the interplay between dividend sustainability and the company’s strategic priorities will be vital in making informed decisions regarding their investments.

Frequently Asked Questions

What is the current price target for Bristol Myers Squibb stock?

The current price target for Bristol Myers Squibb stock has been lowered to $60 from a previous target of $70, following a recent analysis of the company’s earnings and stock performance.

How do Bristol Myers earnings impact its price target?

Bristol Myers earnings are a critical factor in determining its price target, as the company’s recent earnings beat helped surpass expectations, but concerns regarding its drug pipeline and market conditions led to a price target reduction.

What factors influenced the change in Bristol Myers price target?

The recent change in Bristol Myers price target was influenced by lower revenue from certain drugs, disappointing trial results for its schizophrenia treatment Cobenfy, and ongoing tariff uncertainties affecting market sentiment.

What is the forecasted revenue for Bristol Myers in 2025?

Bristol Myers Squibb’s revenue forecast for 2025 is estimated to range between $45.8 billion to $46.8 billion, reflecting adjustments based on foreign-exchange benefits and the performance of its growth portfolio.

How might the failure of Cobenfy’s trial affect Bristol Myers stock analysis?

The failure of the Cobenfy trial may negatively influence Bristol Myers stock analysis as it raises concerns about the company’s ability to navigate competition and execute successful trials, directly impacting investor confidence and stock performance.

What are the potential implications of Bristol Myers’ patent expirations on its price target?

The impending patent expirations of key products like Eliquis and Opdivo could present challenges for Bristol Myers, impacting its revenue stream and subsequently influencing analysts’ evaluations of the company’s price target.

How does Bristol Myers Squibb plan to address its pipeline issues?

Bristol Myers plans to address its pipeline issues by focusing on the growth potential of Cobenfy, pursuing new trials for additional indications, and continuing business development opportunities to enhance its drugs portfolio.

What recent developments have impacted Bristol Myers stock performance?

Recent developments such as tariff uncertainties, disappointing clinical trial outcomes for Cobenfy, and inconsistent performances of legacy drugs have all contributed to fluctuations in Bristol Myers Squibb’s stock performance.

| Key Point | Details |

|---|---|

| Earnings Report | Bristol Myers beat earnings expectations with adjusted EPS of $1.80 against expectations of $1.49. |

| Revenue Performance | First-quarter revenue totaled $11.2 billion, exceeding estimates but declining 6% year-over-year. |

| Stock Performance | Shares lost around 20% in April, trading above $48 amid tariff and pipeline concerns. |

| Price Target Adjustment | Price target lowered to $60 from $70, maintaining a hold rating of 2. |

| Pipeline Issues | The failure of the Cobenfy schizophrenia trial raised concerns about Bristol Myers’ growth prospects. |

| Future Outlook | Company expects to navigate patent expirations with growth drugs including Cobenfy and increased guidance for 2025. |

| Market Strategy | Company focusing on positioning Cobenfy in the market and expanding trial uses for additional conditions. |

| Investor Sentiment | Despite challenges, the dividend yield and valuation remain attractive for investors. |

Summary

The Bristol Myers Squibb price target has been revised downwards to $60, despite the company posting stronger than expected earnings. This change reflects ongoing concerns regarding the pharmaceutical giant’s ability to navigate competitive pressures from generic drugs and the recent disappointing results of key drug trials, notably Cobenfy. Though the first-quarter results were solid, the mixed responses in the market emphasize the importance of effective management of their drug pipeline. Investors remain hopeful as Bristol Myers remains committed to enhancing its portfolio against the backdrop of looming patent expirations.