Medicare drug price negotiations have emerged as a critical topic in the ongoing discussion surrounding healthcare reform. Following former President Trump’s recent executive order aimed at modifying these negotiations, the pharmaceutical industry is poised for significant changes. This directive seeks to address the longstanding discrepancies in how small-molecule drugs and biologics are treated under current law. By allowing Medicare to negotiate prices more freely, the initiative may lead to a re-evaluation of pharmaceutical pricing strategies and could have profound impacts on Medicare spending. As stakeholders from patients to lawmakers weigh in on this potential shift, the implications for drug pricing reform are not only timely but essential for the future of accessible healthcare.

The recent developments regarding Medicare drug price negotiations signal a pivotal moment in the healthcare sector. In an effort to reshape how drug prices are determined for Medicare beneficiaries, a new directive has been put forth by former President Trump. This initiative highlights the existing disparities between different categories of pharmaceuticals, specifically between biologics and traditional medications. The proposed reforms aim to rectify these inequalities, potentially leading to more equitable access to medications for patients. Such sweeping changes could redefine the landscape of drug pricing and have lasting effects on both the pharmaceutical industry and the healthcare system as a whole.

Understanding Medicare Drug Price Negotiations

Medicare drug price negotiations represent a critical aspect of healthcare reform in the United States. By allowing Medicare to negotiate prices directly with pharmaceutical companies, policymakers aim to lower the costs of prescription medications for millions of Americans. This process is particularly significant for small-molecule drugs, which often serve as the first-line treatment for various conditions. These negotiations can ultimately help reduce Medicare spending and lower premiums for beneficiaries, making healthcare more affordable for those who rely on these life-saving medications.

However, recent executive orders and proposed changes surrounding Medicare drug price negotiations have stirred debate within the pharmaceutical industry. The Trump administration’s move to potentially alter negotiations—favoring the pharmaceutical industry by extending timelines for price adjustments—highlights the ongoing tension between cost-control measures and pharmaceutical company profits. Understanding the nuances in small-molecule drug pricing is essential for grasping how these negotiations impact innovation and availability of important medications.

The Impact of Trump’s Executive Order on Pharma

President Trump’s executive order is viewed as a pivotal moment in the continuous effort to reform drug pricing in America. By directing HHS to modify Medicare drug price negotiation rules, the order seeks to rectify perceived inequities between small-molecule drugs and biologics. This ‘pill penalty’ has long been criticized for dampening innovation in small-molecule therapies, as it restricts their entry into price negotiations too soon. As such, pharmaceutical companies are advocating for changes that may extend their pricing power at least four more years, significantly affecting profitability and market dynamics.

Additionally, while the pharmaceutical industry may benefit from these shifts, the implications for Medicare spending are alarming. Analysts predict that extending the negotiation period could lead to higher drug prices and increased premiums for Part D plans, ultimately placing a heavier financial burden on Medicare beneficiaries. This delicate balance between safeguarding the financial interests of pharmaceutical companies and controlling Medicare expenditure is a crucial component of broader drug pricing reform discussions.

Bipartisan response to these potential changes is equally important, as lawmakers understand the dual need for innovation incentives and affordability. If successful, Trump’s changes could reshape the landscape of Medicare spending and drug availability, creating reasonable middle ground between manufacturers and the patients who rely on their products.

Pharmaceutical Industry Changes and Their Effects

The pharmaceutical industry has undergone significant changes in response to ongoing pressures for reform, including rising public concerns over drug prices and the demand for more affordable healthcare options. Trump’s executive order seeks to adjust the Medicare drug price negotiations, particularly concerning small-molecule drugs, reflecting a broader trend in the industry towards addressing pricing disparities. With the ongoing evolution of drug pricing reform, pharmaceutical companies are re-evaluating their strategies to meet regulatory demands while maintaining profitability.

Moreover, emerging trends in the industry indicate a shift towards more competitive pricing structures, particularly for drugs that have recently lost patent protection. Interestingly, smaller biotech companies often specialize in small-molecule drugs due to their lower production costs. As the industry adapts to these reforms, understanding the implications on research and development investments becomes essential. The quest for innovations in treatments could be hindered if funding is reallocated in ways that prioritize immediate financial returns over long-term patient benefits.

Negotiation Rules and Their Impact on Medicare Spending

The negotiation rules established for Medicare drug price negotiations are designed to balance drug pricing with access. Under the current framework, there is significant disparity between how small-molecule drugs and biologics are treated, with drastic implications for Medicare spending. By allowing manufacturers a longer time frame to maintain market exclusivity with small-molecule drugs, spending in the Medicare program may increase, straining the system and potentially leading to higher out-of-pocket costs for patients.

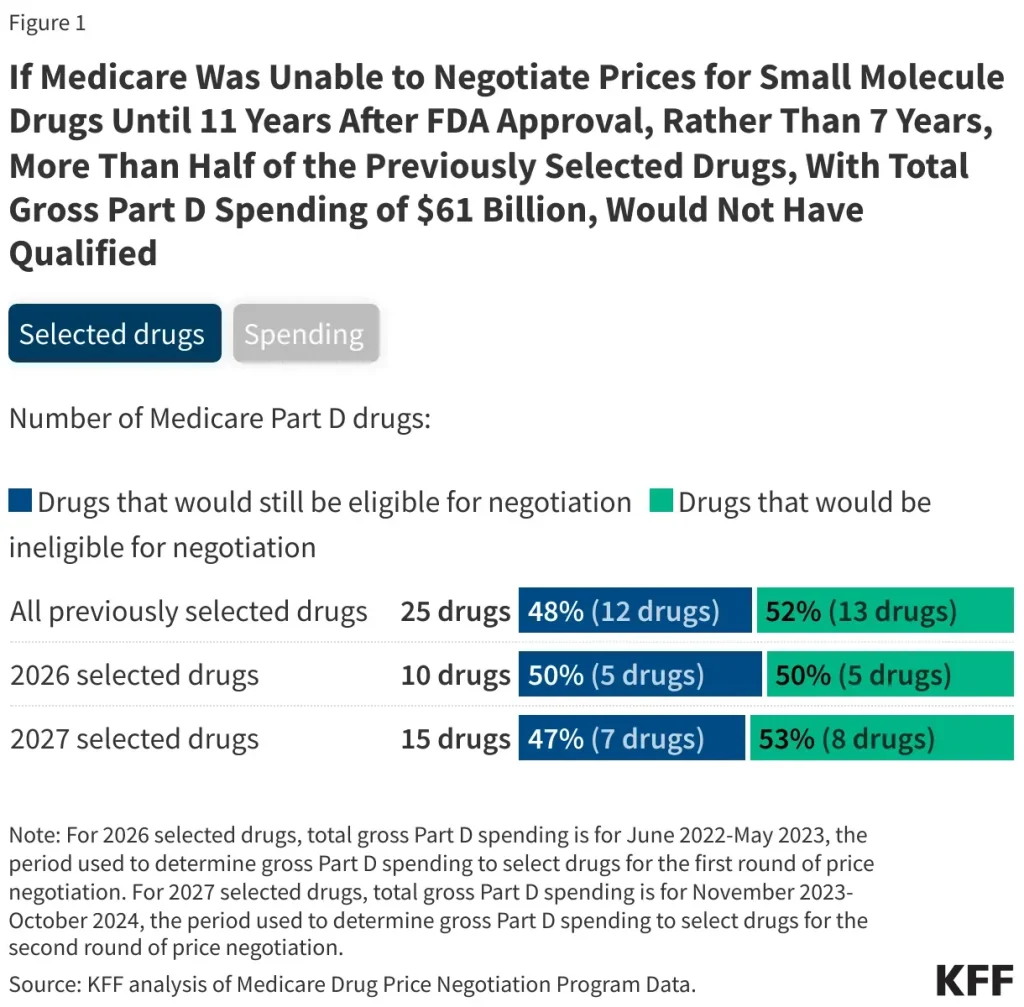

The analysis from KFF indicates that approximately half of the drugs targeted in the first rounds of negotiations might have been ineligible due to these discrepancies. As policymakers contemplate alterations to Medicare drug pricing rules, understanding the regulatory landscape will be essential for forecasting Medicare’s future sustenance and beneficiaries’ costs. Ensuring that negotiations effectively control spending without stifling innovation is a nuanced challenge that requires comprehensive evaluation and collaboration among stakeholders.

The Role of Small-Molecule Drugs in Healthcare

Small-molecule drugs play an essential role in modern medicine, often serving as the backbone for treatments across various therapeutic areas. Their properties—such as ease of manufacture, lower costs, and convenient administration methods—make them particularly attractive for patients and healthcare systems. However, recent changes proposed in Medicare drug price negotiations, influenced by Trump’s executive order, reflect a potential challenge for their future availability. By potentially extending the time these drugs can remain without price negotiations, Medicare spending may rise, ultimately impacting costs for both the program and its beneficiaries.

As healthcare continues to evolve, the importance of balancing access and affordability with innovation cannot be overstated. The pharmaceutical industry’s focus on small-molecule drugs should not only center around profitability but also on the patient experience, affordability, and the essential role these medications play in managing chronic diseases. Stakeholder discussions must prioritize maintaining drug accessibility while also encouraging pharmaceutical advancements that lead to better health outcomes.

Bipartisan Support for Drug Pricing Reforms

Bipartisan support for reforms in drug pricing is crucial for establishing a more equitable system. Recent legislative efforts aimed at addressing the disparities in how small-molecule drugs and biologics are treated under Medicare reflect a growing consensus among lawmakers from different sides of the aisle. The proposed adjustments to the drug price negotiation framework could resonate well with both Democratic and Republican lawmakers, particularly as they grapple with soaring healthcare costs and the public’s demand for more affordable medication.

A cooperative judicial approach may enable Congress to enact more comprehensive reforms that not only address the negotiation rules but also encourage competition within the pharmaceutical industry. By tackling the ‘pill penalty’ issue head-on and working towards more synchronized expiration periods for drug pricing negotiations, the focus can shift from immediate profits to long-term patient health and accessibility.

Potential Consequences of Altering Drug Price Negotiation Regulations

Altering drug price negotiation regulations could have far-reaching consequences, both positive and negative. If the proposed changes outlined in the executive order lead to extended periods of pricing exclusivity for small-molecule drugs, it could deter new competitors from entering the market. This consolidation may benefit established pharmaceutical companies financially in the short term. However, in the long run, it could stifle competition and innovation, ultimately limiting options for patients and deferring much-needed breakthroughs in drug development.

On the flip side, if enacted effectively, these changes could provide stability within the sector, leading to increased investments from pharmaceutical companies in small-molecule drug research. As companies feel secure about their financial returns, there could be a resurgence of innovation aimed at developing new therapies for underserved conditions. Hence, The challenge lies in navigating this complex landscape and ensuring that reforms strike the right balance between sustaining industry profits and ensuring drugs remain affordable and accessible for patients.

Future of Drug Pricing in the U.S. Market

The U.S. drug pricing landscape is poised for significant shifts, especially in light of the recent policy changes surrounding Medicare drug price negotiations. The ongoing discussions about the pharmaceutical industry reflect broader dynamics about healthcare accessibility, affordability, and innovation. Companies are likely to face new pressures to justify their pricing strategies while remaining competitive in a market increasingly scrutinized by the public and lawmakers alike.

Additionally, as regulatory frameworks evolve, the focus will increasingly include ensuring timely access to essential medications at lower costs. This trajectory will challenge pharmaceutical firms to innovate not only in drug development but also in their pricing and market access strategies. The future of medication affordability will hinge on cooperative efforts between governmental bodies, healthcare providers, and the pharmaceutical industry to ensure the sustainable availability of both small-molecule and biologic therapies.

The Importance of Transparency in Drug Pricing

Transparency in drug pricing has emerged as a pivotal issue amid the ongoing reforms in the healthcare sector. As drug prices continue to be a point of contention for patients and policymakers, ensuring that consumers understand the price structures and costs behind pharmaceuticals has never been more crucial. Making pricing data accessible can foster a more competitive environment that discourages excessive pricing practices while empowering patients to make informed choices about their medications.

Transparency initiatives could significantly impact how negotiations unfold in the Medicare drug pricing arena. If both the government and consumers have clearer visibility into drug costs, it may force pharmaceutical companies to reevaluate their pricing strategies, especially if public outcry arises over exorbitant costs. By aligning industry practices with a commitment to transparency, stakeholders can work together to create a healthcare system that prioritizes patient welfare and reduces overall drug spending.

Frequently Asked Questions

What is Medicare drug price negotiation and how does the Trump executive order impact it?

Medicare drug price negotiation refers to the ability of Medicare to negotiate prices directly with pharmaceutical manufacturers for covered drugs. The Trump executive order proposes changes that could alter current regulations, particularly by eliminating the distinction between small-molecule drugs and biologics. This change could lead to increased spending in Medicare as small-molecule drugs would remain unregulated for an extended period, affecting overall drug pricing reform.

How does the Trump executive order address pharmaceutical industry changes regarding drug pricing?

The Trump executive order targets specific provisions in the Inflation Reduction Act, particularly the Medicare drug price negotiation rules, to address concerns from the pharmaceutical industry. By seeking to modify regulations that create a ‘pill penalty’ for small-molecule drugs compared to biologics, the order aims to foster innovation and potentially stabilize drug prices. This could further influence future pharmaceutical industry changes.

What are the implications of Medicare drug price negotiation changes for small-molecule drugs?

Changes to Medicare drug price negotiation rules, as suggested by the Trump executive order, could significantly impact small-molecule drugs. These drugs, which are often more affordable and easier to produce, might not face price negotiations until several years after their release. This delay could result in higher costs for Medicare and beneficiaries as drug companies maintain control over pricing for longer periods.

Can you explain how the ‘pill penalty’ affects Medicare spending on drugs?

The ‘pill penalty’ describes the discrepancy in the negotiation period for small-molecule drugs versus biologics. Under current laws, small-molecule drugs are eligible for price negotiation after nine years, while biologics are protected for 13 years. If changes allowed small-molecule drugs the same duration, it would delay negotiations and likely increase Medicare spending on these medications due to lack of price control, impacting beneficiaries directly.

What potential benefits and drawbacks come from the Trump executive order on drug pricing reform?

The Trump executive order presents potential benefits by addressing concerns from the pharmaceutical industry regarding the current negotiation structures. It seeks to promote investment in drug development. However, drawbacks include increased Medicare spending as small-molecule drugs might not undergo price negotiations for longer, possibly resulting in higher costs for consumers and premiums in Medicare Part D plans.

What role does the FDA play in the context of Medicare drug price negotiations as per the Trump executive order?

The FDA’s role in the context of Medicare drug price negotiations, as articulated in the Trump executive order, involves facilitating more drug imports, particularly from countries like Canada, where drugs are cheaper. This directive indicates a shift towards increasing access to affordable medications while potentially challenging the existing pharmaceutical pricing structures in the U.S.

| Key Point | Details |

|---|---|

| Trump’s Executive Order | Targets Medicare drug price negotiations, seeking changes beneficial to pharmaceutical companies. |

| Medicare Negotiation Rules | Currently differentiates between small-molecule drugs and biologics, allowing biologics a longer exclusivity period. |

| ‘Pill Penalty’ Issue | Drugmakers argue this disparity discourages the development of small-molecule drugs. |

| Potential Legislative Support | Bipartisan interests may align to address the current negotiation rules. |

| Impact on Spending | Changing negotiations could lead to increased drug spending, higher prices, and premiums. |

| Direct Beneficiaries | Novo Nordisk and other major drug manufacturers might benefit from rule changes. |

| FDA and Drug Imports | The order includes plans for increased drug imports from Canada, which could lower costs. |

| Concerns from Analysts | Analysts voice concerns about future tariff plans and further reforms impacting the industry. |

Summary

Medicare drug price negotiations are being reshaped by recent executive actions aimed at favoring the pharmaceutical industry. President Trump’s proposals could alter how Medicare negotiates drug prices, particularly by extending the exclusivity period for small-molecule drugs, a move critics argue may increase costs for Medicare and its beneficiaries. This initiative highlights the longstanding tension between drug companies and the government’s pricing strategies, as lawmakers consider the broader implications of these changes.